By Doug McConnell

Recently a large, loosely coordinated group of individual ‘retail investors’ have been buying up stocks that certain hedge funds had bet against (i.e. ‘shorted’). In doing so, the retail investors have driven up the price of those stocks. This has caused hedge funds that shorted the stock to lose billions of dollars and enabled a number of retail investors to get rich in the process. The phenomenon is anthropologically interesting because it is symbolic of a shift in power away from the traditional Wall Street players towards less wealthy, less well-connected individuals. But what are the ethics of this? Did Average Joe Trader just bring a measure of justice to Wall Street? Or did the mob unethically manipulate the market? If they did, are their actions any more unethical than the usual behaviour of institutional investors?

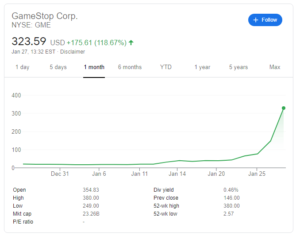

The company at the centre of this drama is GameStop, a computer game and console retailer with brick and mortar stores. In a familiar story for many retailers, it has come under pressure in recent times because people can order games to be delivered or simply download them; the pandemic keeping people at home hasn’t helped either. A number of hedge funds predicted that GameStop’s stock (GME) price didn’t properly reflect the real trouble the company was in. The stock appeared overvalued making it a good candidate for short selling.

Short selling a stock is where you temporarily borrow a company’s stock and immediately sell it (say for £1). The short seller then waits for the price of the stock to go down. When they think it has gone about as low as its going to go, they buy it back. At the end of the agreed borrowing time the short seller is obliged to return the stock it borrowed. If the stock went down in price (say to 70p), they make the difference (30p) but, if the stock goes up over that time, they lose the difference. The maximum one could make is if the stock becomes virtually w orthless (£1 in our example) but the losses are potentially unlimited because there is no upper limit on the stock value. If a £1 share goes up to £100, for example, the short seller loses £99. GME was shorted at ~$20 and, at time of writing, is currently valued at over $300. How did this happen?

orthless (£1 in our example) but the losses are potentially unlimited because there is no upper limit on the stock value. If a £1 share goes up to £100, for example, the short seller loses £99. GME was shorted at ~$20 and, at time of writing, is currently valued at over $300. How did this happen?

The initial motivation to invest in GME was, apparently, based on the judgment (see here and here) that GameStop was undervalued so the short sellers had made a mistake. Then a group of retail investors in an online reddit forum WallStreetBets realised that there was an opportunity for a short squeeze (details here). If enough of them bought stock they would increase its price enough to ‘squeeze’ the short sellers into rebuying their stock to cut their losses. This adds fuel to the fire, further pushing up the stock price and tightening the squeeze for any remaining short sellers. GME was fertile ground for a short squeeze because a high proportion of stock had been shorted – i.e. there was a lot of potential fuel to add to the fire.

As word got around the internet, more retail investors piled in seeing the opportunity to hurt hedge funds and/or make money from the expected boost in stock prices form short sellers buying their stock back. Of course, nearly everyone understood that this was risky speculation; the fundamentals of GameStop as a company remained the same so it was very likely that the stock was now well-overvalued (despite some believing its real value is surprisingly high). At some stage the price will correct leaving the speculators scrambling to get out with what they can.

Was this an illegal or unethical market manipulation which wronged the short selling hedge funds? Or is it just a case of caveat emptor; the hedge funds got beaten at their own game?

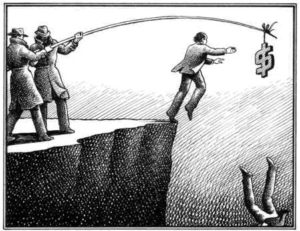

Stock markets don’t run purely on a principle of ‘buyer beware’. Market manipulation is illegal and takes informational and transactional forms. A “pump and dump”, for example, is an informational manipulation where one establishes a position, spreads misinformation about how successful the company will be (possibly including selling stock to others), and then sells everything once the stock has increased in price. Everyone else is then left holding the overvalued stock.

A classic form of transactional manipulation is “painting the tape” where a colluding group of investors sell a stock among themselves to artificia lly increase its volume of sales. This draws the attention of investors who use sales volume to detect opportunities. Those investors buy the stock, increasing the price, at which point the manipulators sell and leave everyone else holding inflated stock.

lly increase its volume of sales. This draws the attention of investors who use sales volume to detect opportunities. Those investors buy the stock, increasing the price, at which point the manipulators sell and leave everyone else holding inflated stock.

A complication with transactional manipulation is that any large purchase or sale of stock affects that stock’s value, especially for relatively small companies. Therefore, to be illegal, a transaction that influences the price of a stock also has to be intended to manipulate the price.

These rules have an ethical basis. Misinformation undermines trust which discourages investment and undermines cooperative enterprise. Society is better when we can cooperate so there is an ethical reason to limit misinformation (i.e. to limit freedom of speech). Without restrictions on transactional manipulations the biggest players can take advantage of their size to control prices to their advantage (and to the disadvantage of smaller investors). In the interests of a fair playing field for investors regardless of their size limits are placed on freedom of investment. There might also be an ethical reason to prevent trading that causes large over or undervaluation of stocks if we agree that we would prefer a less volatile, less risky stock market to invest in.

In the GameStop case, the retail investors weren’t spreading deceptive information about the company value. If this is an example of market manipulation it is manipulation through transaction – deliberately pushing up the price of a stock well beyond its true value. A short squeeze doesn’t necessarily involve manipulation – it can also happen when the prospects of a company with heavily shorted stock unexpectedly improve. In that case investors motivated by what they believe to be genuine value buy the stock. Initially the increasing stock price might track a realistic assessment of the company’s new value bu t if short sellers buy back to cut their losses the stock could then be pushed much higher. This volatility comes as part of allowing short selling. To complicate matters, speculators might take advantage of a ‘naturally’ occurring short squeeze without being guilty of market manipulation.

t if short sellers buy back to cut their losses the stock could then be pushed much higher. This volatility comes as part of allowing short selling. To complicate matters, speculators might take advantage of a ‘naturally’ occurring short squeeze without being guilty of market manipulation.

As the Securities and Exchange Commission states, however, “a scheme to manipulate the price or availability of stock in order to cause a short squeeze is illegal.” Speaking about the GME short squeeze, Dr Elvis Jarnecic, senior lecturer at the University of Sydney Business School, claims that, “if institutions did this to inflate prices … away from fundamental values they’d receive enormous fines in regards to manipulating the market.”

There are however a range of disanalogies between an institution doing this and a group of retail investors doing it.

For the purposes of comparison, imagine an institution that, like some of the retail investors, publicly declares its intention to trigger the GME short squeeze. As an institutional investor it has a relatively centralised decision-making system and that decision-making system controls the transactions the company makes. Therefore, it acts out its intention, because it has a huge amount of money, succeeds in single-handedly manipulating the market. This is clearly illegal as Jarnecic claims.

Did the retail investors buying GME engage in the same kind of unethical transactional manipulation? This depends on whether these investors intended to manipulate the market and whether they had the power to do so. The intentions of many of those who came to invest in GME cannot be known. Some investment in GME was, initially based on a judgment that the short sellers had underestimated its value. Others saw a stock going up and jumped on the bandwagon, yet others were just in it to hurt a hedge fund. Only some of the retail investors made their intention to manipulate the price of GME public in online forums. So, if any of the retail investors are guilty of manipulating the market, it seems likely to be people in that subset.

But did any of those with the intention to manipulate the price also have enough money to significantly increase the price? If so, those individuals may well be in trouble, however, very few, if any, would have had enough money to change the price much.

Perhaps some ringleaders could still be held responsible because they incited a mob with the collective power to manipulate the market? This isn’t very plausible, however. The call to invest in GME isn’t exactly like shouting ‘fire’ in a crowded cinema – a crowd can be reasonably expected to panic upon hearing ‘fire’ in an enclosed space but it’s hard to believe a suggestion to ‘invest!’ could undermine others’ autonomy.

A more plausible possibility is that enough intentional manipulators colluded so that collectively they had the power to change the price. But what was the extent of collusion here? Suggesting to others on an online forum that they should invest in GME doesn’t appear a particularly strong form of collusion. If a group of intentional manipulators pooled their money and initiated the short squeeze as a group then, at that point, they look very much like the guilty institutional investor above. However, I doubt that such strong collusion took place.

In summary, if one needs both the intention and the means to be guilty of manipulating the market, it might be difficult to find a guilty party among the retail investors.

Returning to institutional investors, it seems pretty unlikely that they would generally be caught for orchestrating a squeeze. In our example above we imagined that the institution publicly stated an intention to manipulate the market; in reality this wouldn’t happen. Investors don’t have to declare their real intentions and they could hide behind the lie that the investment was based on a judgment that there was real value in the company.

Given the difficulties in working out whether retail investors or institutions are responsible for orchestrating short squeezes, what might we do?

One option is to just accept that sometimes people will get away with orchestrating short squeezes and that this is an unavoidable contributor to market volatility. Given the rising influence of vindictive, righteously indignant, or otherwise economically ‘irrational’ retail investors the phenomenon and associated volatility might be on the increase. If so, short positions are becoming riskier than they were in the past but investors can factor in. Some might see this as a useful dampener on short selling.

A second option is to ban short selling to eliminate the conditions for short squeezes, orchestrated or otherwise. In fact, short selling has been banned on occasion because it can exacerbate a market crash. The Securities and Exchange Commission banned short selling in 2008 to try and stabilise dramatic market losses. But short selling itself is not generally considered a bad thing and isn’t necessarily an attempt to undermine a company. It is seen as a good way to make the market more responsive to the true value of companies – if a stock is perceived to be overvalued, its value will correct more efficiently if people can bet against it. The benefits of short selling are generally thought to outweigh its downsides but perhaps that will change in response to investor behaviour.

A third option might be to dispense with working out an investor’s intentions and simply prevent trades that meet agreed criteria for ‘appearing’ manipulative. This is well outside my expertise, but I suspect the difficulty in creating such rules is that they will tend to have unintended and unwelcome side effects.

Finally, is there some sense in which justice was served by those who orchestrated the GME short squeeze? Well, perhaps in a highly imperfect sense. If one believes that the world’s wealth should be distributed more equally, the GME short squeeze made a very small improvement by transferring wealth from the (mainly) very wealthy to the (mainly) slightly less wealthy. But overall it didn’t get much wealth to the many people who need it the most. One also has to be prepared to overlook the fact that the redistribution depended, in part, on wrongful market manipulation.

If one thinks that there are institutional investors who need to be punished for their past behaviour (the 2008 crash etc), the GME short squeeze managed to make a couple of hedge funds pay. It’s not clear that this was proportional to what they deserved and it seems more likely that they just happened to be in the firing line. Nevertheless, for people who think Wall Street is due some punishment, it’s probably seen as a good start.

I see it much easier..

Free markets!

All investors start with lection 1: put money in the line and you can win it, or you can lose it!

Make a decision after you understand its implications and the if then logic beforehand.

Never be so stubborn to believe you know the future. You don’t. Be smart!

With that said:

Thats the market. Individual players, some big, some small, made their decisions, some won, some lost. As always will be. Some will win, some will lose.

Where is the difference between:

A) retails orchestrating 6 million times 1000 dollars average and….

B) hedgefund orchestrating 6 million times 1.000 dollars fundinvestors/ customers… or even 6000 times 1.000.000 dollars.

Hedges are having insider information, networks, communicate with each other, meet up to make decisions, even get all the retail inv. trading patterns aka robin hood data for a mere annual 0.X% of their trading volume…

Retails have no possibility for that.

Leave the market free.

Every regulation from stupid politicians (be it dems or reps, or whatever the idiots are called in other countries than the US) doesn’t help the market to get fairer. But rather the opposite.

A whole class of investors (retail) just found a nice way to make best use of what they have to work a profitable strategy… Let them do it.

Will easily change the strategy of hedgies and other classes of investors to be much less risky and greedy, thus much more realistically grounded… and investing will be much more carefully and overall self-contained behavior in the future.

If we want the market to be a place for investing in companies rather than gambling like a casino… We should allow the competitive players to punish gamblers by fucking them hard in the ass… Even if that involves gambling in the first place.

Profitable strategies are then carefully ones in long term… It’s just turbulence now.

Think about the police:

Why do we arm officers? Because it’s necessary to build a counterweight against criminals.

In our world nowadays, crime – albeit a profitable strategy against weak people – turned a high risk to lose it all business… Thanks to powerful executive powers that physically the same as the criminals in first place… Imprisoning to jail, shooting, sentencing and confiscate the riches… Of the criminals.

This analogy is not trying to say that one’s are criminal and others aren’t, I don’t belive that…. But rather the technical function of natural regulation taking place.

Don’t generally fear a rule that involves gambling on both sides…

The overall effect can be exactly the opposite: much less gambling in future.

And also pls remember:

There is no 100% security without totally giving up freedom, and there is no 100% freedom without totally giving up security.

Its not about finding the optimum in security in the market… nor about optimum in freedom.

It’s to find a best balance point and fair rules that apply to everyone.

A good start would be…

Realize that the company evaluation is only partly subjective, but greatly objective.

If you base the value of a company only on its numbers, space x would be worth nothing, it’s only making losses now. Value is based on perception of people, expected future potential, the believe in the expertise and management, coolness, trends, hypes, political regulations…

How would you really defend the claim that GME is overvalued at 80$ a stock?

I could easily argue: new management, solid customer base, global operation.

Even I can now say: “with that hype, GME is very popular and this is huge marketing push, slingshotting it’s transformation to go online and therefore I expect the sales not only to double, but to quadruple and more… So I think 100 bucks is totally low.. It’s worth 200 FOR ME!

WHAT NOW?

Just leave 5he market alone and stop having rigged rules that inherently favor 1 class of players over the other.

We all agree that having different privileges for the blacks and whites is a dumb and inhumanly bad idea.

It’s good that these times are over since some 6 centuries now in the racial debate… let’s overcome these in the market debate next, please.

I would suggest, contra the prior commentator, that the solution is: Ban short sales, under all circumstances.

Per the author’s description, short sales amount to an inverted Pascal’s Wager: the potential gain is limited, the potential loss is limitless. They may make adjustments of stock valuation more “efficient” in some abstract sense, but at least to me, this doesn’t seem worth the cost in increased volatility and risk for all investors.

I would actually recommend the more extreme measure of banning stock markets, full stop. As Ariely points out, all trades of financial instruments such as stocks, things whose only value inheres in the money one can get from them, are innately irrational. Buyer and seller agree on a price. The buyer believes that the instrument is worth more than the negotiated price, or they wouldn’t buy. The seller believes that the instrument is worth less than the negotiated price, or they wouldn’t sell. At least one of them has to be wrong. Stock trading is therefore somewhere between legal gambling and instituionalized fraud.

“The buyer believes that the instrument is worth more than the negotiated price, or they wouldn’t buy. The seller believes that the instrument is worth less than the negotiated price, or they wouldn’t sell. At least one of them has to be wrong.”

That’s simply not true. Value and worth are in the eyes of the beholder. Even when buying a product with cash, you’re making the determination that the product is worth more to you than the cash. For the retailer, the cash is more important than the product. The two see different value and worth in the product because one can make as many of that product as they choose and the other doesn’t want to waste the resources to make one.

Hedge funds shorted the entire Russell2000 a few weeks ago and on Monday (4/12) hedge funds sold (shorted) through the major exchanges and bought through FADF (a dark pool). so that they could manipulate the share-price. Right when AMC was trying to cross $ 14 that would have allowed options to expire in the money, they created a wall so that each time the stock hit $ 14.00, it dropped to $13.99. You could see what was happening. The order book during active trading and after hours was different. The short shares spread evenly to keep the share price from going beyond $14 disappeared after hours. When I contacted Td Ameritrade about what was going on, I spoke to a new broker who looked at AMC and told me that he had never seen anything like this before and would have to speak with his supervisor. There were 600,000 shares to be purchased that were never processed through the system and when the broker returned to the phone, he said that all he was told to tell me was that you can see that the share price dropped by more than $1 at 3:59 but he could not tell me anything more. I wrote to Td Ameritrade and asked for a return call but never heard back.

I have invested in stocks such as FATE, NVAX and both were the subject of short attacks that drove the price down to the point I sold at a loss, only to have the stock hit new highs much later on. Hedge funds have been fleecing capital from the small investor for years. THere is a great divide between the wealthy and those trying to make money on investing When this problem is finally addressed, maybe the majority of the public will once again, have faith in the government that pretends to have their best interest ‘at heart’

The Hedge Funds lost their own game. It is difficult to believe that any retail investor, or group of retail investors could have beaten them by organizing any kind of short squeeze. The Hedge Funds have Billions, if not Trillions of dollars under management to orchestrate what happens in the Market. No retail group has the buying power that they do. The Hedge Funds looked at the company and thought that Brick and Mortar was done, not looking into the strength of the brand or the possibility that once the Pandemic began to wind down, they would be able to bounce back.

I believe that the way to combat this type of action by the Hedge Funds is twofold. First, we should strive to make the same information that is available to hedge funds also available to the general public in a timely manner, so that one cannot have a major advantage over the other. Second, I believe that some form of tracking for every transaction should be available, such as what Paxos is trying to do.

If we have blockchain T+1 (or T+0) settlement, along with publicly available positions, everyone can see exactly what is being done. Then it would naturally curb naked shorts, and large volume short selling. It would make the risk too great unless the company is truly on its way down. With the current system, if a short seller manages to severely short and dilute a stock to the point of bankruptcy, that seller doesn’t have to deliver the shares borrowed, nor does it have to pay taxes on that profit.

And if all of the information is publicly available, people can be on the lookout for Naked Shorts, and react accordingly. It is a gamble for both sides, but if both sides are playing by the same rules and with similar information, the gamble is more equitable. Both sides would know the other’s position, and both sides could know what they stand to win or lose.

Comments are closed.